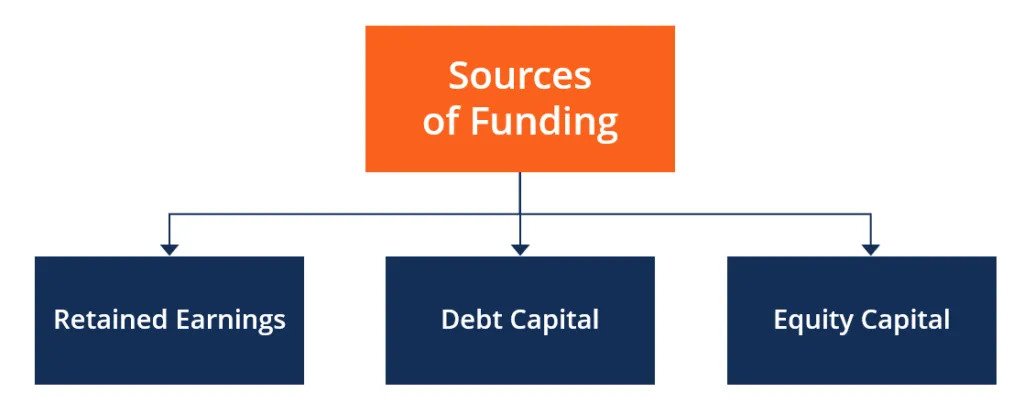

There are several sources of business financing, including traditional bank loans, lines of credit, equipment financing, invoice factoring, venture capital, angel investors, crowdfunding, and personal savings or investments. Lets now talk about how many types sources of business financing.

1. The Different Types of Finance

There are many different types of finance, each with its own unique set of characteristics. The most common types of finance are:

- 1. Debt financing

- 2. Equity financing

- 3. Hybrid financing

- 4. Mezzanine financing

- 5. Venture capital

- 6. Angel investment

- 7. Private equity

- 8. Hedge funds

- 9. Mutual funds

- 10. Pension funds

1. Debt financing: Debt financing is the most common type of financing, and it refers to the borrowing of money that must be repaid with interest. The borrower may be a government, a corporation, or an individual. The lender may be a bank, a financial institution, or an individual.

2. Equity financing: Equity financing is the second most common type of financing. It refers to the sale of ownership stakes in a company in exchange for money. The money raised through equity financing can be used to finance the growth of the company or to pay for other expenses.

3. Hybrid financing: Hybrid financing is a type of financing that combines elements of both debt and equity financing. The most common type of hybrid financing is the convertible bond, which can be converted into equity at the discretion of the bondholder.

4. Mezzanine financing: Mezzanine financing is a type of financing that is typically used by small and medium-sized businesses. It is a combination of debt and equity financing, and it typically has a higher interest rate than traditional debt financing.

5. Venture capital: Venture capital is a type of financing that is typically used by startups and other high-growth companies. Venture capitalists provide money in exchange for an ownership stake in the company.

6. Angel investment: Angel investment is a type of financing that is provided by wealthy individuals who invest in startups and other high-growth companies. Angel investors typically provide money in exchange for an ownership stake in the company.

7. Private equity: Private equity is a type of financing that is provided by private equity firms. Private equity firms invest in companies that are not publicly traded.

8. Hedge funds: Hedge funds are a type of investment fund that pools money from investors and invests in a variety of

Earn online: Buy adsense approved websites, Happy Propose Day Quotes, Wishes, and Messages, Spiritual Good Morning Messages and Quotes

The Importance of Finance

Finance is a critical component of any business, large or small. It is important to understand the different types of finance available and how they can be used to support your business.

There are broadly four types of finance:

1. Debt finance

2. Equity Finance

3. Mezzanine finance

4. Venture capital

Debt finance is the most common form of finance for businesses. It is typically in the form of a loan from a bank or other financial institution. The loan is repaid over an agreed period of time with interest.

Equity finance is where investors provide capital in exchange for an ownership stake in the business. This can be in the form of shares or convertible debt.

Mezzanine finance is a hybrid of debt and equity finance. It typically takes the form of a loan that is convertible into equity if certain conditions are met.

Venture capital is a type of equity finance that is typically provided by specialist investors for high-growth businesses.

Each type of finance has its own advantages and disadvantages. The most appropriate type of finance for your business will depend on a number of factors, including the stage of your business, your growth plans, and the level of risk you are willing to take.

It is important to seek professional advice to ensure you choose the right type of finance for your business.

Read and Share: Cute Love Paragraphs For Her To Wake Up To, Good Morning Bible Verses and Quotes

The Different Types of Financial Institutions

There are a variety of financial institutions that cater to different needs. Here are three of the most common types:

1. Commercial Banks

Commercial banks are the most common type of financial institution. They offer a wide range of services, including savings and checking accounts, loans, and investment products.

2. Credit Unions

Credit unions are not-for-profit organizations that are owned and controlled by their members. They offer many of the same services as commercial banks, but they often have lower fees and rates.

3. Investment Banks

Investment banks focus on activities such as underwriting and trading securities. They also provide advisory services to companies and governments.

The Different Types of Financial Instruments

Most people think of cash when they think of financial instruments. However, there are actually four different types of financial instruments: cash, debt, equity, and derivatives. Each has its own characteristics, risks, and rewards.

1. Cash: Cash is the most basic type of financial instrument. It includes physical currency, as well as demand deposits (such as checking accounts) and other highly liquid assets. Cash is the most liquid asset, which means it can be quickly converted into other assets or used to pay debts. However, it also has the lowest return of all the financial instruments.

2. Debt: Debt instruments are loans that must be repaid with interest. They include bonds, bills, and notes. Debt instruments are less liquid than cash, but more liquid than equity. They also have a higher return than cash, but a lower return than equity.

3. Equity: Equity instruments are ownership interests in a company or other entity. They include stocks, mutual fund shares, and limited partnership interests. Equity instruments are the least liquid of all financial instruments, but they have the highest return potential.

4. Derivatives: Derivatives are financial instruments that derive their value from another asset. They include options, futures, and swaps. Derivatives are the most complex and risky of all financial instruments, but they can also have the highest return potential.

5. The Different Types of Financial Markets

Financial markets are institutions where people trade financial securities and derivatives at low transaction costs. Securities include stocks, bonds, and currencies. Derivatives include futures, options, and swaps.

There are five different types of financial markets:

1. Capital markets: A capital market is a market for equity and debt instruments. Equity instruments include stocks and mutual funds. Debt instruments include bonds, treasury bills, and commercial paper.

2. Derivatives markets: A derivatives market is a market for derivatives. Derivatives are financial instruments whose value is derived from the value of underlying assets. Common derivatives include futures, options, and swaps.

3. Currency markets: A currency market is a market for currencies. Currencies are traded in pairs, with each currency being traded against another. The most common currency pairs are the euro/dollar (EUR/USD) and the dollar/yen (USD/JPY).

4. Commodity markets: A commodity market is a market for commodities. Commodities are physical goods such as oil, gold, and wheat. They are traded in futures contracts, with each contract specifying the quantity and delivery date of the commodity.

5. Financial services markets: A financial services market is a market for financial services. Financial services include banking, insurance, and investment. They are typically provided by financial institutions such as banks and insurance companies.

6. The Different Types of Financial Transactions

When it comes to financing, there are many different types of transactions that can take place. Here are six of the most common:

1. Equity Transactions

Equity transactions involve the buying and selling of ownership stakes in a company. This can be done through the stock market, or through private transactions between two parties.

2. Debt Transactions

Debt transactions involve the borrowing and lending of money. This can be done through loans, bonds, and other financial instruments.

3. Derivatives Transactions

Derivatives are financial instruments that are derived from other assets. This can include things like futures contracts, options, and swaps.

4. Foreign Exchange Transactions

Foreign exchange transactions involve the exchange of one currency for another. This is often done in the form of currency trading.

5. Commodities Transactions

Commodities transactions involve the buying and selling of raw materials and other goods. This can include things like oil, gold, and wheat.

6. Real Estate Transactions

Real estate transactions involve the buying and selling of property. This can include both residential and commercial properties.

7. The Different Types of Financial Services

Financial services are the economic services provided by the finance industry, which encompasses a broad range of businesses that manage money.

The finance industry includes banks, credit unions, insurance companies, investment firms, and other businesses that offer financial products and services to consumers, businesses, and governments.

Financial services are the backbone of the global economy, and the different types of financial services that exist are essential to keeping the world economy running smoothly.

The different types of financial services can be broadly classified into four categories: banking, insurance, investment, and lending.

Banking

Banking services are the most basic and essential type of financial service. Banks are responsible for keeping people’s money safe and for facilitating the transfer of money between individuals and businesses.

Banks offer a wide range of services, including savings and checking accounts, loans, credit cards, and investment products.

Insurance

Insurance is a type of financial service that helps protect people from the financial risks of unexpected events, such as accidents, illnesses, or death.

Insurance companies offer a variety of insurance products, such as life insurance, health insurance, car insurance, and homeowners insurance.

Investment

Investment services are financial services that help people save for the future and grow their money.

Investment firms offer a variety of investment products, such as stocks, bonds, and mutual funds, to help people save for retirement, college, or other long-term goals.

Read and share:

Lending

Lending services are financial services that provide people with the money they need to buy homes, cars, or other expensive items.

Lenders offer a variety of loans, such as mortgages, auto loans, and personal loans, to help people finance the purchase of big-ticket items.

The different types of financial services are essential to the functioning of the global economy.

Each type of financial service plays a vital role in helping people save for the future, grow their money, and protect themselves from financial risks.

Read more: sources of finance for small business, what are the 5 sources of finance, what are the primary sources of funding for entrepreneurs, sources of finance for business, sources of finance for entrepreneurs